Electronic IRS Form 940 (Schedule R) Template 2024-2025

Show details

Hide details

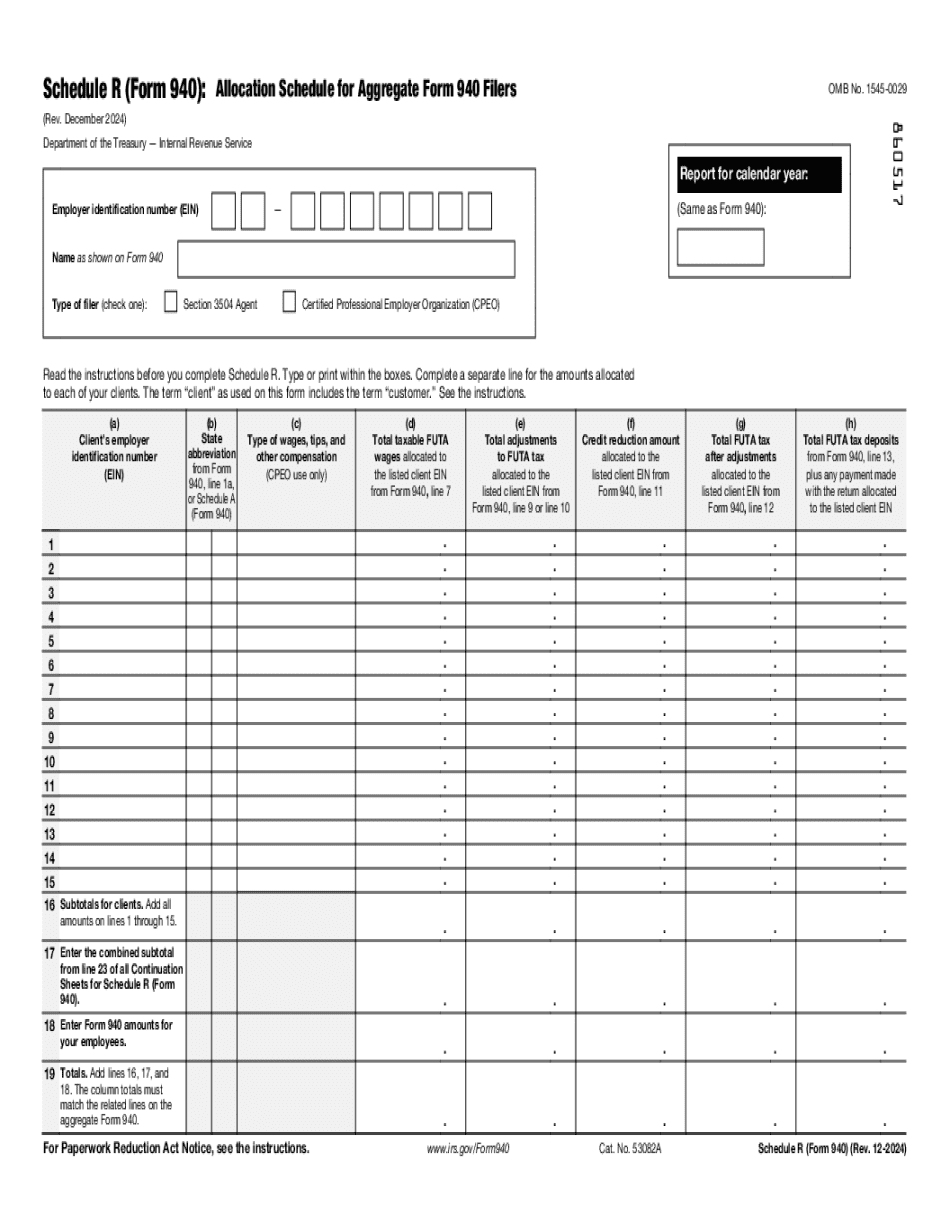

Line 19 including the aggregate Form 940. For each column total the relevant line from Form 940 is noted in the column heading. Calendar Year Enter the calendar year for which you are filing your Form 940. Make sure that the year entered on the top of Schedule R matches the year on the attached Form 940. If the totals on Schedule R line 19 don t match the totals on Form 940 there is an error that must be corrected before submitting Form 940 and Schedule R. Paperwork Reduction Act Notice ...

4.5 satisfied · 46 votes

form-940-schedule-r.com is not affiliated with IRS

Filling out Form 940 (Schedule R) online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to Form 940 (Schedule R)

Every person must report on their finances on time during tax season, providing information the IRS requires as accurately as possible. If you need to Form 940 (Schedule R), our reliable and intuitive service is here at your disposal.

Follow the instructions below to Form 940 (Schedule R) promptly and accurately:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official guidelines (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Fill out your template using the Text tool and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Make use of the Highlight option to stress particular details and Erase if something is not applicable any longer.

- 06Click the page arrangements key on the left to rotate or delete unwanted document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or choose Mail by USPS to request postal report delivery.

Select the simplest way to Form 940 (Schedule R) and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Irs Form 940 Instructions?

Online solutions allow you to organize your file administration and improve the productiveness of the workflow. Follow the brief information to be able to complete Irs Form 940 Instructions, prevent mistakes and furnish it in a timely manner:

How to complete a Irs Schedule R Instructions?

- 01On the website hosting the document, click on Start Now and go towards the editor.

- 02Use the clues to fill out the suitable fields.

- 03Include your individual details and contact information.

- 04Make absolutely sure you enter right data and numbers in suitable fields.

- 05Carefully check the written content in the form so as grammar and spelling.

- 06Refer to Help section in case you have any questions or address our Support staff.

- 07Put an electronic signature on the Irs Form 940 Instructions printable using the help of Sign Tool.

- 08Once document is finished, press Done.

- 09Distribute the prepared blank by using electronic mail or fax, print it out or save on your gadget.

PDF editor allows you to make alterations towards your Irs Form 940 Instructions Fill Online from any internet linked device, customize it in line with your requirements, sign it electronically and distribute in several ways.

Watch our video guide to learn how to prepare Form 940 (Schedule R)

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 940 (Schedule R)?

Form 940 (Schedule R) is the official tax form used by tax return preparers to prepare your return for the tax year you file. All of your income and allowable deductions will appear on this form, including taxes withheld from pay or other amounts received by you. Your total tax liability will be the sum of tax withheld from your pay and other taxes taken out of your checking or other accounts.

You can view and print any or all of the following information on the Form 940 (Schedule R):

The return date on which you filed

The type of return you filed

Information about your tax status. See What Is the Income Tax Status I Should Use? Below.

Additional information about your income or deductions. These include: Your federal and state income tax returns: Income tax return summary.

Social Security, Medicare and pension income tax returns.

Pension income tax returns.

Other Form 940 (Schedule R) forms you filed for services and expenses, like: Insurance coverage information

Employer benefits

Student loans

Credit card debts

Other government benefits

Payroll deductions

Included in your return Other information that is not required to be reported in Form 940 (Schedule R) Income from non-taxable sources — such as income from self-employment, interest and dividends, capital gains and income from investments

— such as income from self-employment, interest and dividends, capital gains and income from investments Your net interest, dividends, capital gains, and other income

The amount of all required deductions

Any itemized deductions you made

The amount of any credits granted, reduced, or withheld

Any additional personal exemptions You must submit a copy of your completed Form 940 (Schedule R) with each federal tax return that you file as soon as the IRS tells you that they need it to send your return. Your original Form 940 (Schedule R) may not be able to contain important information that the IRS uses to figure the portion of your tax liability that you should report on Form 1040, as described in the instructions for Form 1040. You may need more information to figure any income from self-employment or taxable sources that is not included in your Form 940 (Schedule R) unless you are using Form 940 (Schedule R) in conjunction with a return filed by other taxpayers.

Who should complete Form 940 (Schedule R)?

C. The CRA should send Form 940 (Schedule R) if you do not report a loss from a business at a lower rate than the tax credit rate, or you have an investment loss reported on Form 1320 (Investment Income Tax Return — Small Business and Certain Professional Businesses).

When do I need to complete Form 940 (Schedule R)?

This IRS form is only for employees, business owners, trustees, or other individuals making over 100,000 a year for self-employment purposes. If you expect to make over 118,500 a year, however, you should use Form 941.

How much are you paid for taxes withheld under my employer plan (such as a 401(k)?

When you are paid from a paycheck and are required to pay income tax withheld from your paycheck, you will be taxed under the rules of the particular plan. However, you will have different income tax withholding requirements under various IRS plans and tax forms.

You may need to provide additional information about your wages so that your employer may determine your tax withholding requirements for the year.

Why would tax forms such as W-2s, 1099s, or 1099-MISC be used when the IRS is more appropriate?

This information is used primarily to calculate withholding. Employers may provide employers' services if you do not have a W-2, 1099, or 1099-MISC. You are also required to keep documents such as W-2, 1099, 1119, or 1095-EZ and income tax returns and statements for the year in the business records' area of your employment and to keep these records as specified in your contract.

Is a 401(k) plan or a similar plan a plan under which an employer pays income tax?

This depends on the provisions of the plan and its tax status. Generally, a 401(k) plan or similar arrangement is not a plan under which an employer pays income tax. (See Regulations section 1.401(k)/4-402(m).) An employer that pays an employee money for expenses such as meals, coffee in lieu of meals or a rental property or a car, for example, would be considered to be paying the employee for services rather than for expenses.

What if I don't know the tax status of my plan?

You may wish to consult with an accountant to help you understand your tax situation. This may include understanding how to calculate your tax withholding with any IRS Form W-2, 1099, 1119, or 1095-EZ you may be required to provide your employer.

Can I create my own Form 940 (Schedule R)?

Yes. You may use this tool to prepare, update, and print Form 940 to generate a copy for filing with the IRS. Use the “File your own Form 940 drop-down menu to select Form 940. When you select “Create a Schedule R” under the “Schedule R” menu, you will be asked to set up the appropriate Form 940 (Schedule R) for your organization. If your organization is a partnership, enter the “G” code and then select “Schedule R.”

Can I create my own Schedule 3 tax form?

Yes. You may use this tool to prepare, update, and print Form 3106 to generate a copy for filing with the IRS. Use the “Start a Schedule” box in the “Form 3106” drop-down menu and select the “Schedule 3” option. To change your tax filing status and to create a tax return, see the “Tax Return Preparation and Filing a Tax Return” section of the Publication 519 in the U.S. Government Printing Office or see Publication 463 in the HHS Publications Online Catalog at . This publication lists a variety of publications that can be used to prepare a tax return. See IRS Publication 519 for more information about the various formats available for Form 3106 and related guidance.

Who should I contact if my tax return is missing information?

Please contact us by email at

Or by phone at.

What can't I do with Form 940 (Schedule R)?

Form 940 (Schedule R) cannot be used to prepare or mail Form 2555, IRS Offers in Compromise.

Is Form 940 (Schedule R) used to prepare federal tax returns?

Most tax returns are prepared using Form 1040 and other forms available in IRS Publication 463. Many companies may also use Form 940 (Schedule R) to prepare their own annual tax returns.

Where can I find more information on Forms 940 (Schedule R), like Form 940 (Schedule R) or Publication 519?

You can find more information on these topics and other tax topics in Publication 519 and IRS Publication 463.

What should I do with Form 940 (Schedule R) when it’s complete?

It has become very common to prepare Form 940 for an individual to obtain a Form 940‑C for a year in which the Form 940 was not properly completed because of a clerical error. This is not a proper method of filing a tax return. We require that you prepare the individual Form 940 in the original and complete form and send it to IRS. (See the instructions for Form 940).

For more information, refer to the section Tax Receipt for Form 940, which applies to individuals who were required to file Form 940, and which can be found on our website.

How do I file Form 940 or Form 941?

Generally, you use the official IRS forms that we provide. Your local tax preparer can assist you to fill in these forms. If you are unsure which form to use, consider using the one that was originally used before a change in the Internal Revenue Service (IRS) forms. This does not necessarily mean that the IRS has updated the form. To find the correct IRS Form 940 or Form 941, see the instructions on Form 940 and Form 941.

Form 3939 is an individual taxpayer identification number, Form 1098‑A is a Social Security Number and Form W‑2G is a W-2G employer identification number. For a complete list of these forms, refer to the instructions on the official IRS forms or contact our Tax Help Hotline.

Form 8939 is a W-4G self-employment tax form for self‑employed taxpayers whose wages are reported to a central account, such as an employment tax return, by employer‑authorized payroll agents. For a complete list of these forms, refer to the instructions on the official IRS forms or contact our Tax Help Hotline.

Form 1512 is a U.S. Social Security number tax form.

What should I do with Form 1099-C?

Use Form 1099‑C when you are reporting non‑cash income or expenses. Form 1099‑C can assist you with a variety of issues that you may need to resolve. The Form 1099‑C can also help you determine your financial interest in Form 8919. You can find information on these forms from the General Instructions for Certain Information Returns.

For more information, see: Tax Topic 462, Foreign Accounts and Foreign Financial Accounts, in Publication 550, Tax Guide for U.S.

How do I get my Form 940 (Schedule R)?

The online IRS e-file software accepts the 2016 Form 940. (You can use your 2013 and earlier Forms 940s in E-file.) To send your Form 940 for an individual or partnership, you must follow these steps:

Download the e-file version of your Form 940.

Enter your information.

Go to IRS.gov, click on “Forms and Publications” > “Download Forms,” select “Electronic Filing” in the “Online Filing” section of the menu bar.

Enter the code 944 on the left of the “Select File” box to view the form.

Click on the “submit” button to complete your return for the 2016 tax year.

For more information about the tax-filing software you can use for your 2017 Form 940 to get a refund or credit or other tax relief, see Tax File/Free File Software.

I'm on temporary layoff. Am I still required to file?

Yes, even if you are temporarily laid off, you are still required to file a Form 940.

However, it is important to understand the law in order to avoid unexpected tax obligations if you do so. The IRS regularly issues notices regarding temporary layoff, and if you do report that you were layoff, there may be some tax consequences, even if you have completed a voluntary separation agreement, such as an EZ 990 or EZ W-2. If, for example, you have a lump-sum amount of money that you want to use for retirement or qualified tax deductions or savings, or you do not plan on using those funds, and you make it clear that you will file your 2016 returns on schedule A, or something similar, it would be a good idea to sign a voluntary separation agreement.

For a more detailed discussion on this issue, see Should I Sign A Form 940 Or Form 990 Instead Of A Voluntary Separation Agreement?

I don't have time for a voluntary separation agreement (or at least not soon enough). Does Form 940 have any other important information on it?

Yes. If you are laid off, you must file a Form 940. If you are not laid off, you should file your 2016 returns for the calendar year in which you were laid off.

What documents do I need to attach to my Form 940 (Schedule R)?

The most recent schedules or Form 940s that you filed prior to June 1 of the current year will be accepted. For additional information on the filing of an amended return, see Pub. 8, Your Federal Income Tax for the Year Ended.

For all other information on filing a Schedule or Form 940 to report your foreign tax, see Income Tax on a Foreign Return.

Where can I get more information?

If you are an individual taxpayer and have questions about foreign earned income or payment of taxes on foreign income, please contact any of the following:

If you are a U.S. employer, please contact any of the following:

If you are a domestic business owner on behalf of your domestic employees, please contact the U.S. Department of Labor, which can provide help with forms, instructions, and other assistance.

If you are a foreign government, or the U.S. government, contact the Internal Revenue Service, which can help inform your employee of their filing obligations under U.S. law by giving them a copy of the U.S. tax code.

What happens if I am a U.S. nonresident alien and I receive foreign income?

Generally, U.S. foreign income tax is assessed on the undistributed earnings of certain foreign corporations. Nonresident aliens residing in the United States generally are considered nonresident aliens for U.S. income tax purposes. The undistributed earnings generally will be taxed at the foreign corporation tax rate on a current basis.

If earnings in excess of earnings subject to U.S. tax are distributed to a nonresident alien under a qualified dividend income allocation plan, there will be an additional 10% nonresident withholding tax to be withheld on the excess distributions and paid to the nonresident alien. In addition, a 10% tax will be imposed on U.S. sources of income attributable to foreign income.

What are qualified dividend income allocations?

Qualified dividend income allocations are specified distributions or income allocated for U.S. federal tax purposes. Any portion of a qualified dividend income allocation which has not yet been distributed, or any portion of the earnings of which is not subject to U.S. income tax, will be subject to U.S. tax on the net income allocated, and the portion allocated after such distribution will be subject to taxes. The applicable income limits were adjusted for inflation in the January 2009 income tax tables.

What are the different types of Form 940 (Schedule R)?

Schedule R is either an Individual Retirement Arrangement (IRA) or a non-deductible retirement deposit account (ROSA). Your employer can use Form 940 (Schedule R), and IRS Publication 590, Distributions and Other Information, to report the amount of contributions to your IRAs; the amount of contributions to your ROSA; the amount and date of withdrawal from your IRA; and the distribution from your ROSA to you or any other person, including a qualified organization. For the most part, these rules are the same as the contributions rules.

Can an IRA owner claim non-qualified distributions from their IRA?

You can get a refund of any non-qualified distributions you may have paid from a Roth IRA, but you cannot get it if you make non-qualified distributions from any other account or plan, such as a defined benefit plan or a 403(b) plan. To prove that you paid a non-qualified distribution of a total basis (cost) basis (as defined in Form 5498) in a plan under section 401(k), check Form 5498, Other Disbursements of Plan Assets.

Related topics

Roth IRA rollovers

What are rollovers?

Rollovers allow you to make a different individual distribution, in the same calendar year, from the same Roth IRAs you already own, to another account in which you or a beneficiary has control. If you need further information, refer to Publication 590-A, Distribution of Nonqualified Distributions. For information about how to take a rollover distribution from your Roth, see Publication 590-B.

What is the difference between an ordinary IRA contribution and a Roth IRA contribution?

An IRA contribution is an amount that you will deposit in your account at one time, whether a year, a quarter, a half, or a full year. When you make an IRA contribution, you generally make a separate distribution of money from your account each time you contribute to it. However, if you are a joint and survivor beneficiary of a traditional IRA distribution, you may have to pay a tax on the amount you contribute if you later withdraw the money from the IRA. To qualify, you must be the designated beneficiary of the distribution on withdrawal.

A Roth IRA contribution is an amount placed in an IRA; no separate distribution is made.

How many people fill out Form 940 (Schedule R) each year?

In 2015, about 30 million filed it, a bit less than the 31 million in 2014, a decline of a little more than 200,000.

Who paid taxes on more than 250,000 in adjusted gross income? In 2015, nearly 12 million filers owed no taxes. That includes the millions of taxpayers who were not taxed in previous years, such as many who were late in filing their returns.

Who paid taxes on more than 500,000 in adjusted gross income? Almost 8 million filers owed no taxes that year. That includes the 4 million people like Donald Trump who were not taxed in previous years, such as some who were late in filing their returns.

Who paid taxes on more than 1 million in adjusted gross income? About 5 million filers owed no taxes that year. But those individuals were in a tiny minority: only about 400,000 filers owed more than 5 million apiece in adjusted gross income.

Why can't those numbers be more like they were in 2011, before the housing bubble and Great Recession depressed tax receipts for people of modest means? Because we got caught up, so to speak, in “fiscal cliff” talk: talk of tax increases on upper-income Americans that could have triggered a recession. The political debate led to cuts in benefits to the middle and lower classes, so Americans felt wealthier, and taxes were raised accordingly.

Now Republicans, including President Trump, say that there should be no tax increases for the rich, and no tax increases at all for anyone other than wealthy individuals, their heirs and corporate executives. They won the argument in 2013, when the House passed a Republican budget that cut 1.5 trillion in domestic spending. That's more than the amount that was proposed in the 2015 tax package, although some of that can be recouped by raising taxes on the wealthy.

It's a tough sell. Americans' support of the tax cuts for the rich dropped 13 percentage points between May and October 2017, according to Gallup Polls.

The bottom line

Even if the Trump administration's tax plan is successful in reducing overall federal tax revenues, it will be very hard to get the revenue generated from high-income earners back, if there is a failure to reduce corporate tax avoidance.

It also will be hard to make up the revenue that was lost as a result of Republican tax increases for the middle class.

Is there a due date for Form 940 (Schedule R)?

Yes. The due date for Schedule R is March 5, 2019, for 2019.

Can my employer pay me a Form 940 (Schedule R) tax?

Yes. The due date for Form 940 (Schedule R) is March 5, 2019, for 2019. You can use Form 1040, U.S. Individual Income Tax Return for Individuals To Be Certified as Fiduciaries, to obtain a copy of Schedule R, if you are a corporation. You can obtain a form from your state agency for a Form W-2, Wage and Tax Statement, if your employer is a large employer. Furthermore, you can obtain a form from your state agency for an employer's Form W-2EZ, Wage and Tax Statement From Self-Employed Persons, if your employer is not a large employer.

What do I have to do to get Form 940 (Schedule R) from my employer?

If you are an employer, the due date is March 5, 2019.

If you are a corporation, the due date is March 5, 2019, and the return must be sent to the IRS by April 1, 2019.

How do I obtain Form 1040 (Schedule S) in electronic format?

You can do so by completing and sending in Form 1040-SIMPLE (Form 1040), U.S. Individual Income Tax Return for Individuals To Be Certified as Fiduciaries. You can use Form 1040-SIMPLE to complete or submit Form 1040-S, U.S. Individual Income Tax Return for Individuals To Be Certified as Fiduciaries.

Furthermore, you can also ask to have Form 1040-SIMPLE electronically filed with Form 1040 (Schedule S). Furthermore, you should ask for this service within six months of filing and should note the amount due on Form 6251.

The IRS will allow electronic filing of Form 1040-SIMPLE if the requested form has been completed and is properly filed. However, in most cases, you may have to submit the original paper Form 1040 and supporting documentation for each Form 1040-SIMPLE electronically. Note that the required documentation for Form 1040-SIMPLE may be electronically submitted only for the information requested and for the filer's address changes.

If you don't have Form 1040-SIMPLE, the IRS may ask you for a paper copy.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here