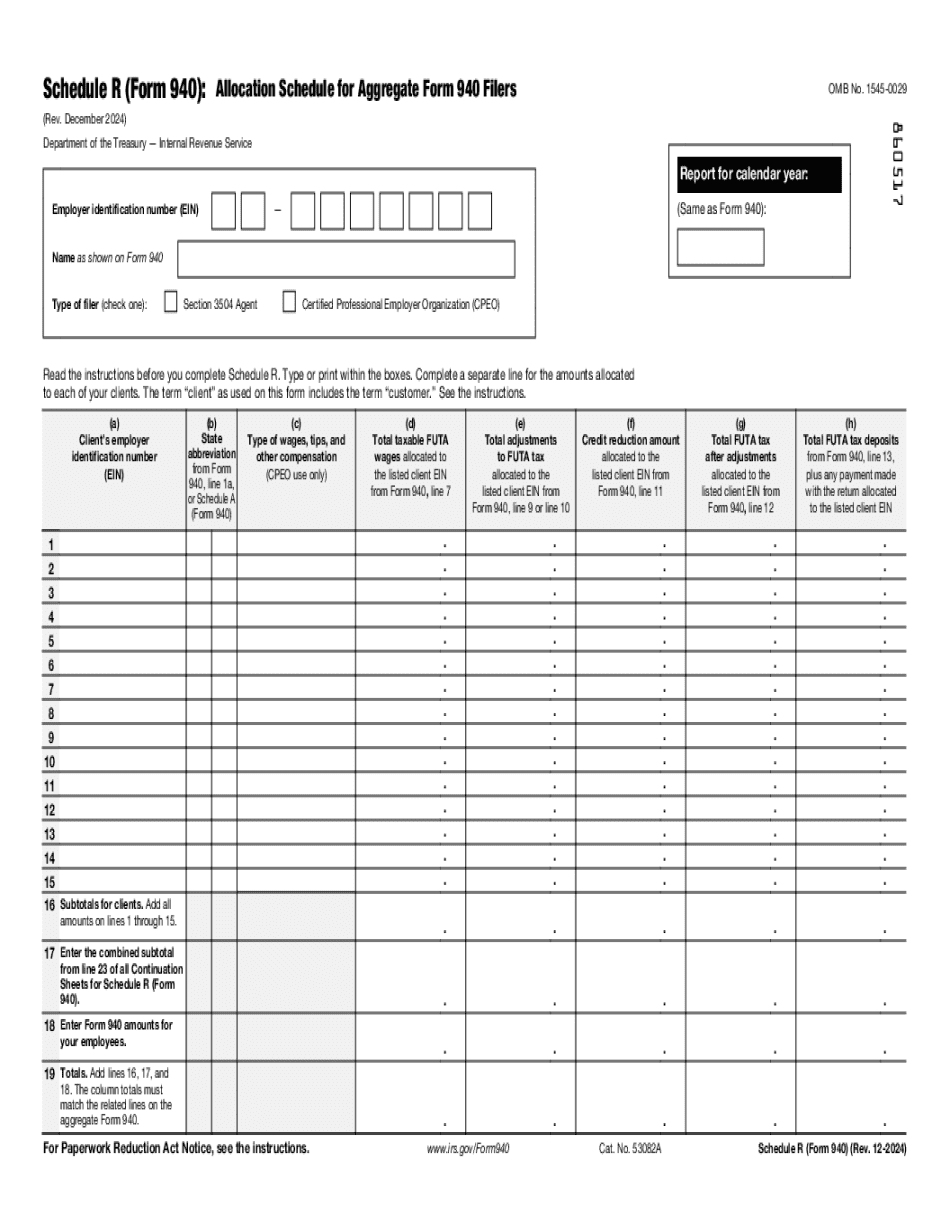

Hi, welcome to Easy Payroll Guide. My name is Karen Hutchinson. In this video, we're going to be completing the IRS Form 940. This is the federal unemployment tax that is owed at the end of each year. It's also known as FUTA, which is the Federal Unemployment Tax Act. We are going to complete the IRS 940 using a fictitious example. This example kind of piggybacks off of the example that I did in my earlier video at the beginning of this page. As we were calculating the FUTA liability, we have three employees in this business. The employees are all paid wages that are taxable for FUTA. Employee A is a resident of Maryland and has been paid a total wage of $16,000. Employee B is a resident of Maryland as well and has been paid wages of $13,000. Employee C is a resident of Delaware and has been paid total wages of $8,000. This is a total of $37,000 paid in wages. I wanted to give you an example of a multi-state 940 as well, so that's why I have one employee here who is a resident of Delaware. This means that the employer would be playing state unemployment taxes to Maryland and to Delaware for its respective employees. So, what this means is that I owe as the employer FUTA wages on the first $21,000, because each of my employees have met the maximum requirement of $7,000. FUTA is paid on the first $7,000 in wages for each employee. Since they all made over $7,000, I'm responsible for paying the full amount of FUTA wage for each employee. So that's $21,000 ($7,000 times 3 employees). I have excess wages of $16,000. If I take my total wages ($37,000) and subtract my FUTA wages ($21,000), you'll see that I've paid excess wages...

Award-winning PDF software

Video instructions and help with filling out and completing Are 940 Schedule Reduction Rates