Award-winning PDF software

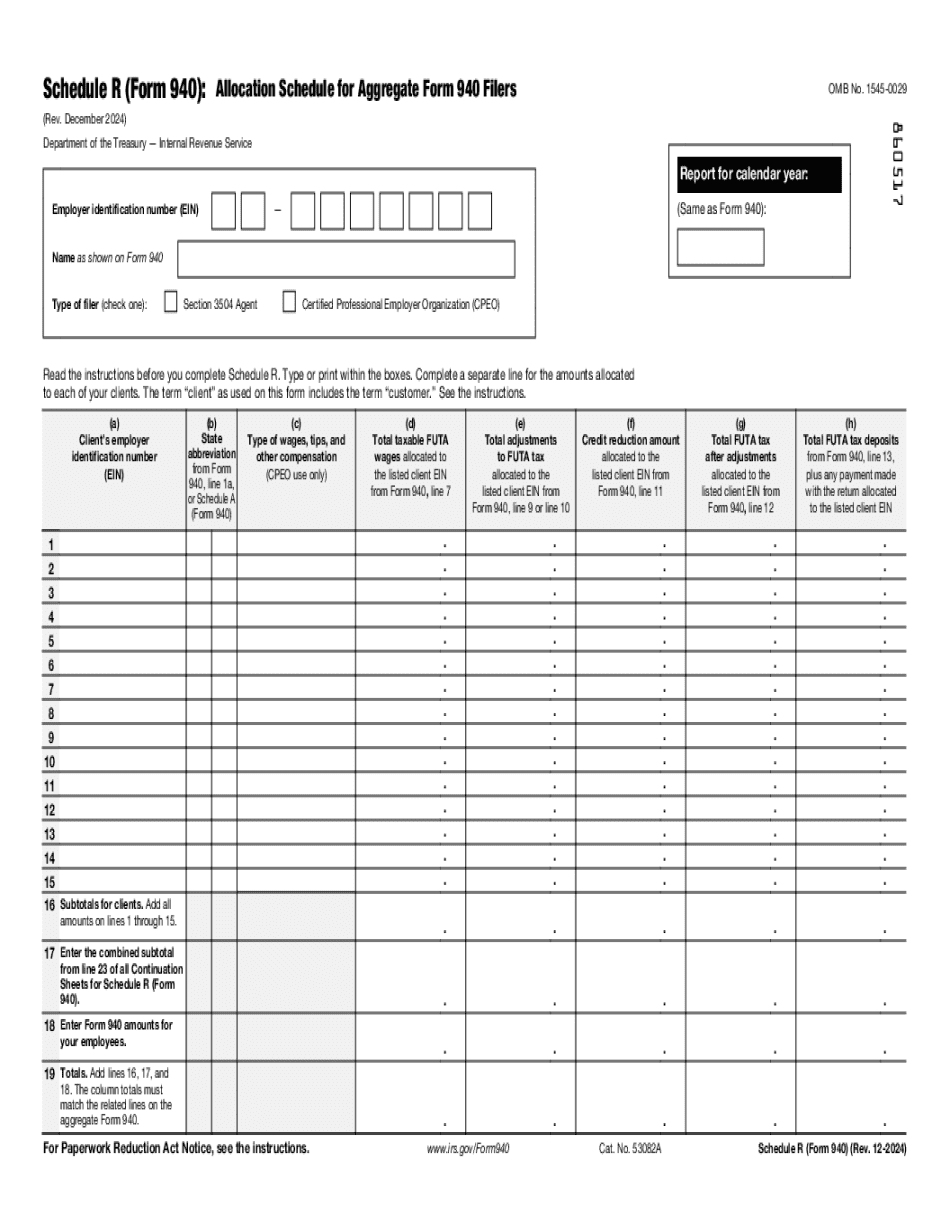

Phoenix Arizona online Form 940 (Schedule R): What You Should Know

Pay your State and Federal Taxes and get Innovative Technology and Best Customer Service; Free Software and Support Fines and Penalties for Not Filing Tax Returns Federal Agency and Government Contracts The Arizona State Treasurer's Office offers a broad network of agents to assist you, from tax preparers to agents, to file and pay your State and Federal tax returns. Our services include: Filing Taxes on Your Own We provide quick, accurate and hassle-free service that will result in your state income tax return being completed and filed on time. We also have extensive experience working with business owners and individuals who want to report on their own returns. Payment of Your Taxes with Cash or Check We accept the following as payment for taxes: Social Security Federal income tax Retiree, Railroad retirement and military retirement benefits Alaska Sales Tax Taxable Products You Can Buy For Your Taxes The Arizona Department of Revenue Service offers the following products to help you file your tax returns: Bingo Registration: For filing federal income tax. Arizona's Business Tax Identification Number This form is used for the registration of businesses in Arizona. It is a business or professional tax identification number, or BTA, issued by the Arizona Department of Revenue. It will show you the type of business and whether the applicant is filing as a sole proprietor, a partnership, a corporation, an S-corporation, or an unincorporated association. Alaska Business Income Tax Identification Number This form is used for the entry of Alaska tax information on federal returns, either electronically or physically. This is a Business Income Tax Identification Number (BIN) issued by the Alaska Department of Revenue. This identification number shows the name and address of a business with which you have done business, and the type of business entity. Information on this form includes the number of employees, business entity type, location of the business, and total annual gross receipts. The BIN serves as a proxy for the tax identification number of the corporation under which a business is conducted. The BIN is not required to use for the filing of Alaska individual income tax returns. A business's information on their own You can use the BIS Tax Data Booklet for your own. All the information you need is in the book. The booklets are available. You can purchase a copy through the Treasurer's Office.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Phoenix Arizona online Form 940 (Schedule R), keep away from glitches and furnish it inside a timely method:

How to complete a Phoenix Arizona online Form 940 (Schedule R)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Phoenix Arizona online Form 940 (Schedule R) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Phoenix Arizona online Form 940 (Schedule R) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.