Award-winning PDF software

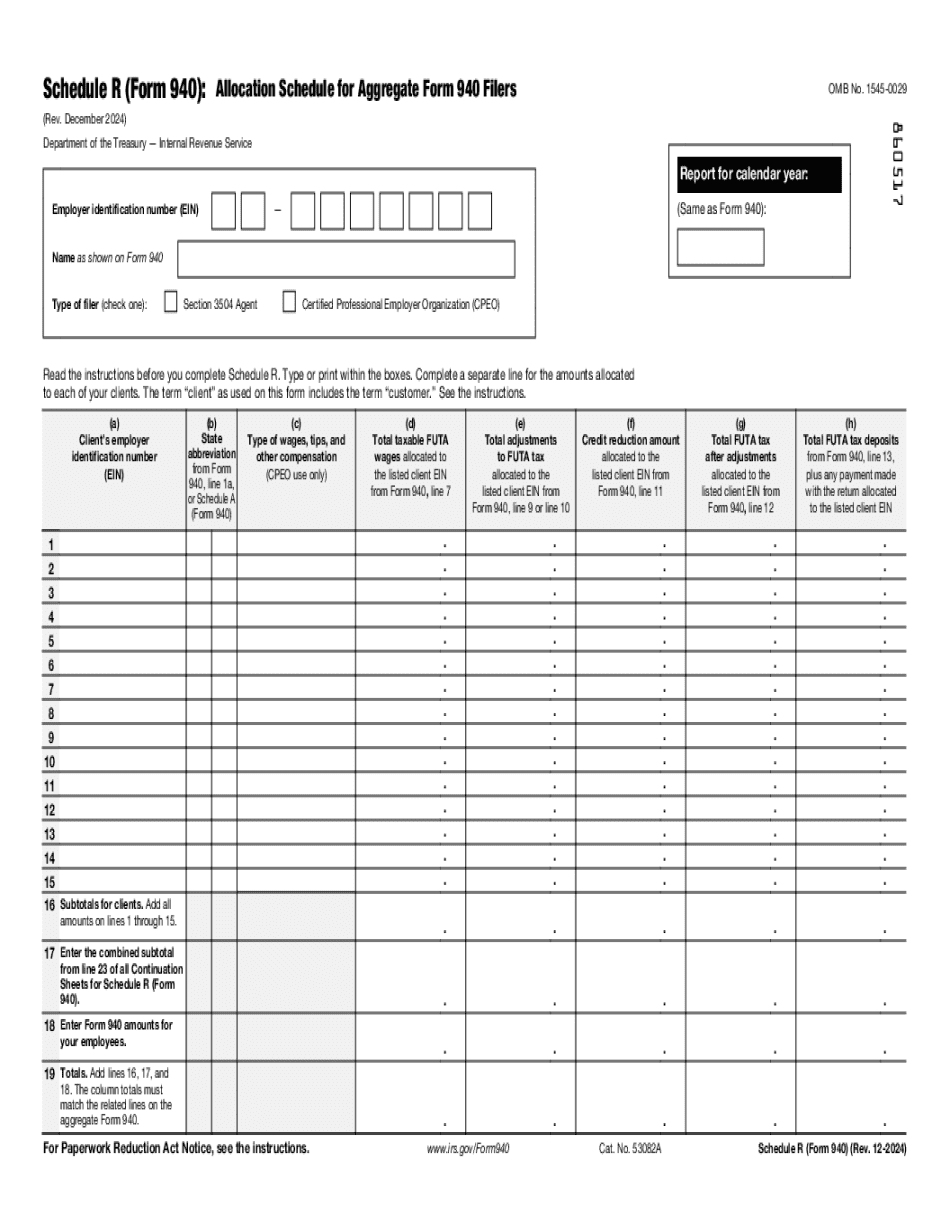

Form 940 (Schedule R) Pearland Texas: What You Should Know

In said records, as set forth and evidenced by all the sources within said records to the contrary is the result of the combination, conspiracy, and arrangement by the defendants [sic] in said indictment and found, the purpose of which is to levy and collect a tax on said people of the city of Pearland, Texas, for the taxes previously assessed, collected, or to be collected for the school expenses of the city of Pearland, Texas, and the property of such people is hereby held to be taxable as herein defined in said tax levy and assessment. Said city council hereby declares as follows on behalf of the people of the city of Pearland, Texas, That the persons herein charged are guilty of and are subject to said unlawful tax and to the lawful consequences thereof. 1. A certified copy of the warrant and charge shall be filed in the office of the (recorder) of births and deaths of the city of Pearland, Texas. Sixty days, starting on Dec. 21, 1998, are allowed against said warrant to file and have proof made hereof. The recorder shall issue a copy of the warrant to an officer of the city where the tax was levied and the said recording officer shall make a receipt for the same within sixty days following. Such warrant shall contain a description of the land upon which the said taxable property is situated, and a statement of the taxes, if any, in respect thereof levied for said school expenses. The warrant may be filed with and shall be served upon the sheriff, or any deputy of the sheriff of the county in the manner provided by law. A notice on the front page of the tax file shall be served upon the persons to be charged with the said taxes in the manner provided by law. 1. The warrant shall be accompanied by a bill therefor which shall specify the amount and date of the tax or assessment; a description of the taxable property, the names and addresses of such owners; and a demand at the same time for a certificate of the tax levy and assessment. The charge shall also specify the amount of the tax levied, the tax rate, and the place or local school district upon the taxable property to which the tax is to be made due. (Note: The charge form is available for download in the Appendix of this pamphlet.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 940 (Schedule R) Pearland Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 940 (Schedule R) Pearland Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on youR Form 940 (Schedule R) Pearland Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with youR Form 940 (Schedule R) Pearland Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.