Award-winning PDF software

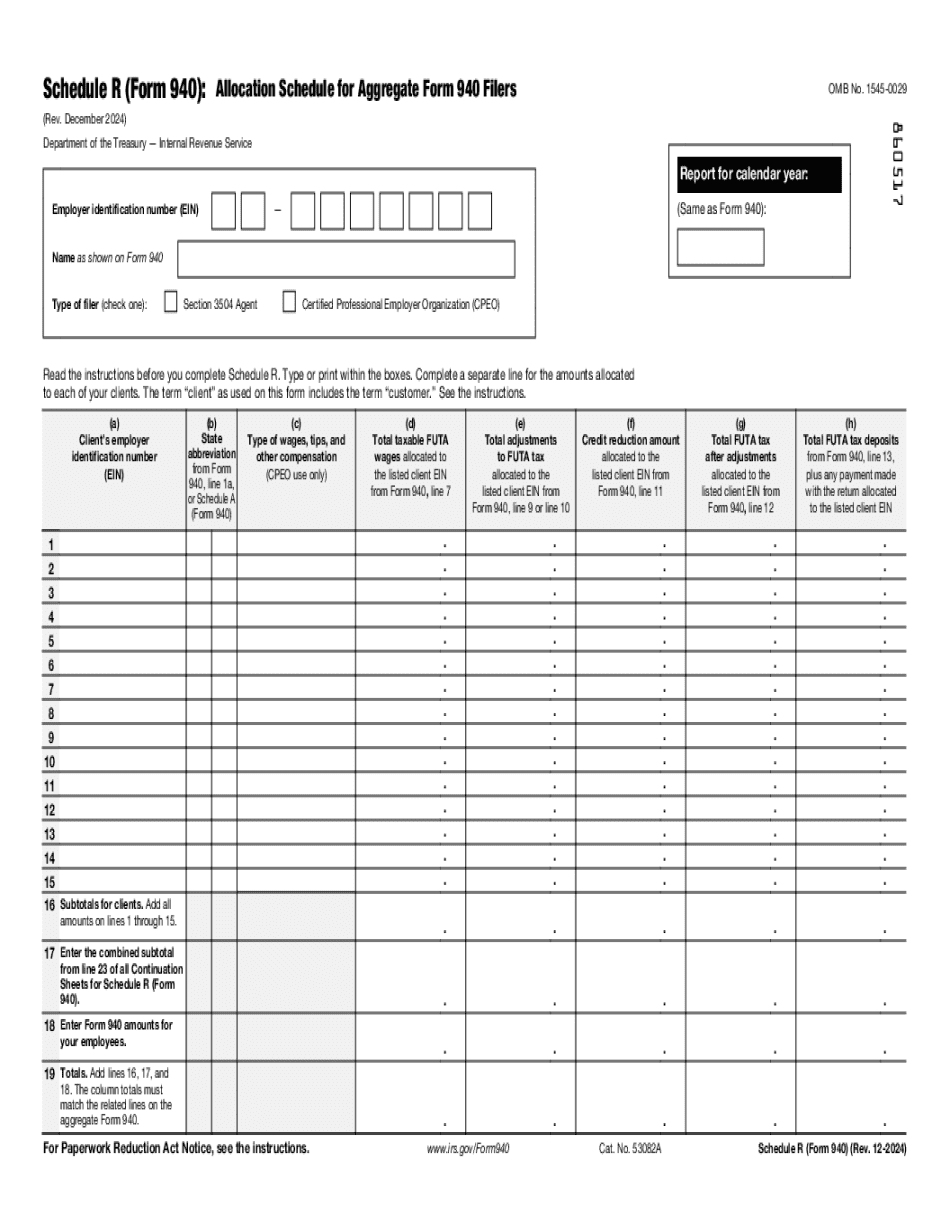

Form 940 (Schedule R) Irvine California: What You Should Know

The Form 940-B is an annual report required by the IRS for reporting the client's wages each year. These forms cover the client's total pay for each reporting period. Form 941 is not required for the client filing the Form 940-B. It is only required for Form 940-A, which the Form 843 must be filed by the payee at the end of every tax year. You can obtain the forms, forms for forms and publications by visiting the IRS website for RMS Law. Form 39.6-1 is a list of exemptions that can be used to claim a credit for business expenses incurred in connection with clients of Crete Advisors. Form 39.6-2 is a list of tax credits that the client may be entitled to claim under IRC Section 3522 where the taxpayer pays either an annual or an aggregate payment for services rendered by one or more principals of the taxpayer. Form 39.6-3 is a list of tax refunds of qualified expenses paid under IRC Section 6721(c), if the taxpayer files Form 39.6-1 or Forms 6919 or 6920. Form 59-2 is a list of federal-state sales and use tax credits that may be claimed by any taxpayer if the taxpayer: 1) has engaged in a trade or business in the state that is subject to payment of the Federal Excise Tax under either IRC Section 6011(a) or IRC Section 6012, and 2) has furnished a check or other payment for all or part of the cost of goods, services, or commodities, directly or indirectly, by the taxpayer to a person for consumption on the premises of the taxpayer; or 3) has furnished a check, other payment, bond, certificate, or other evidence of indebtedness as consideration, directly or indirectly, for the sale of goods, services, or commodities by the taxpayer on the premises of the taxpayer. You may also obtain Forms 39.6-1 and 39.6-2 at our office, located at 925 South Main Street, Irvine. If you contact us and do not qualify for these exemptions, and if we cannot process your request through the exempt status process, we will accept your request or form as is, but at your expense. The IRS will not process any request or other representation that you cannot file the forms on the tax-exempt status form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 940 (Schedule R) Irvine California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 940 (Schedule R) Irvine California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on youR Form 940 (Schedule R) Irvine California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with youR Form 940 (Schedule R) Irvine California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.