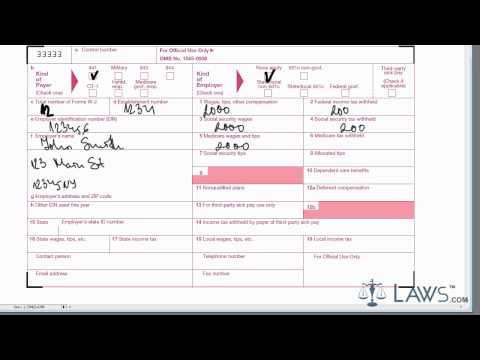

Laws.com legal forms guide form W-3 is a United States Internal Revenue Service tax form used for electronic transmittal of reported income from an employer. The W-3 must be used when the employer files a paper W-2 form and not the electronic version. The form W-3 can be obtained through the IRS's website or by obtaining the documents through a local tax office. First, you must start by indicating the kind of payer and the kind of employer filing the form W-3 in B. Next, list the total number of W-2s covered in C, along with the establishment number, employer identification number, and employer's name and contact information in es C through G on the left section of the form. If the employer has used a different employer identification number during the tax year, indicate so in H. In lines 1 and 2 on the right side of the form, indicate all wages and compensation and the federal income tax withheld. In lines 3 and 4, provide the social security wages distributed and amounts withheld. In lines 5 and 6, provide all Medicare wages distributed and amounts withheld. Any dependent care benefits amount should be reported in 10. Additional payments, including non-qualified plans, deferred compensation, and third-party sick pay, should be reported in es 11 through 13. Provide the state and employer's state identification number in 15. In the corresponding es, indicate the state tax information withheld by the employer over the course of the tax year. Provide a contact name and phone number. Your form W-3 is now ready for electronic submission to the IRS. Retain a copy for your personal records. To watch more videos, please visit laws.com.

Award-winning PDF software

Video instructions and help with filling out and completing Will 940 Schedule R Form