In this presentation, we will take a look at form 940 within QuickBooks. For more accounting information and accounting courses, visit our website at accountinginstruction.info. Here, we are on the home page and currently have open windows open. To open the open windows list, go to the view drop-down. We're going to take a look at the form 940 this time. The form 940 can be generated by QuickBooks if you have the paid version. If you have the manual version, you can't generally run the form 940 within it, although you can run reports and test things out in that format. Here, we have the paid version, so we'll take a look at the form 940 processing. There are a couple of different ways to get in there, but I typically go to the employees up top, then go to the payroll tax forms and W-2s, and then go to the process payroll forms. That will open up the employee center where we're in the file forms section. Now, the 940 is at the end of the year, so don't get it confused with the form 941. It's going to be down here. If we have everything in process for the payroll, if we have properly set up the payroll items, gone through the whole interview section, set up our employees correctly, and processed the payroll correctly throughout the entire year, then the form 940 should process fine by QuickBooks. It is one that we often overlook because it only happens at the end of the year, unlike the 940 ones which will be quarterly. Just remember, at the end of the year, we have the 940, and it's not going to be a summary of the 940 ones. It's going to be different because it's just calculating for...

Award-winning PDF software

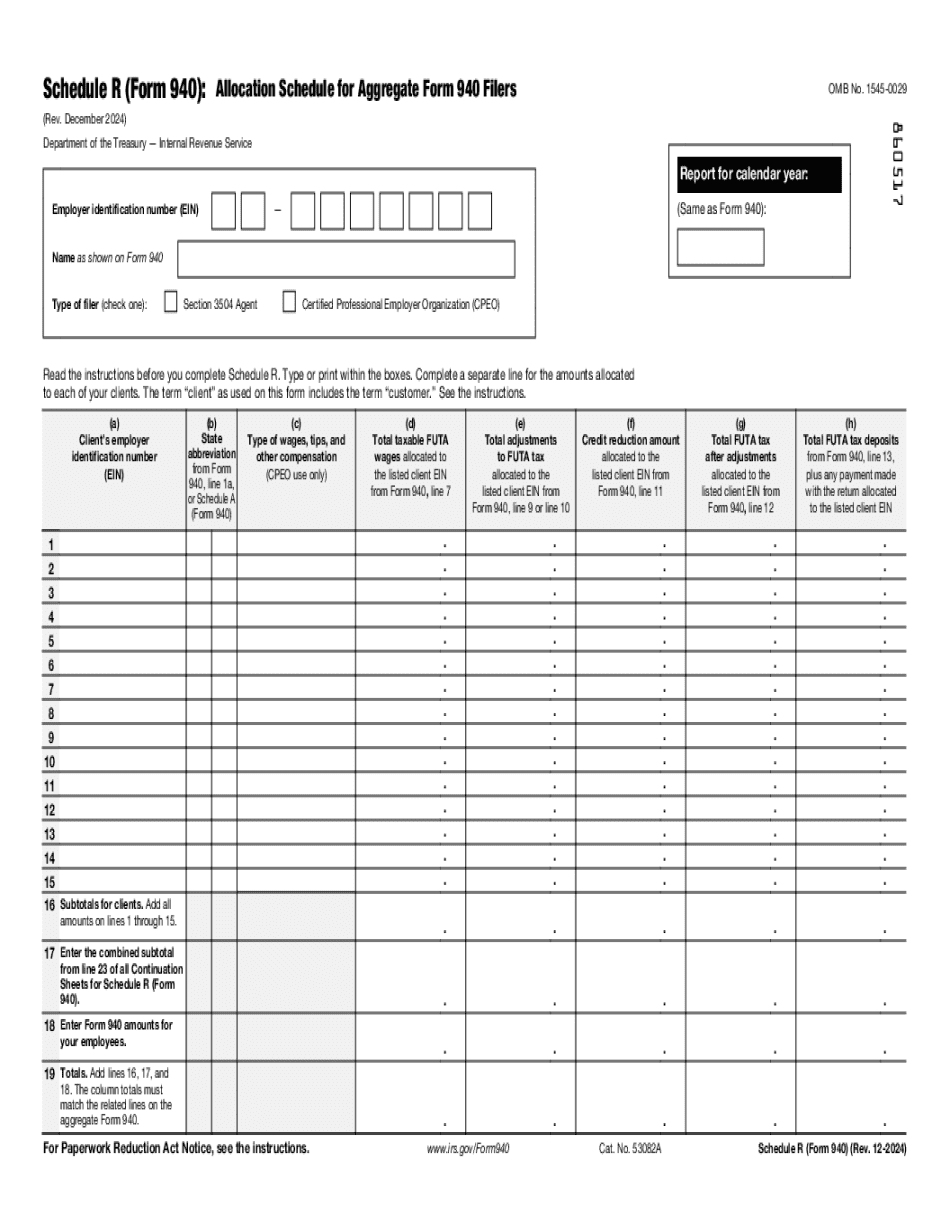

Video instructions and help with filling out and completing Who 940 Schedule Reduction Rates