Welcome back to another video for Harbor Financial Online.com. Today, I'm going to be talking about the 9:40 form instructions. I'm gonna show you guys if you need to fill out this form in a powder form. So, the 940 form is used to report your annual federal unemployment tax known as FUTA. The purpose of the FUTA tax is to provide funds for paying unemployment compensation to workers that have lost their jobs. Employers pay FUTA tax and don't deduct this tax from their employees' wages. You have to file the 940 form if, in a calendar year, you paid wages of $1,500 or more. So, if you're under this $1,500 threshold, you don't have to file the form 940. At our site, Harbor Financial Online.com, you can use an online calculator to estimate what your taxes are going to be. This is a great free tool that we offer at our site that you may want to check out after the video. Now, the rules for the 940 are different based on your situation and the number of employees you may have. Some of these special situations can include household employees in a private home, employees at a local college fraternity or sorority, cash wages paid to farm workers, Indian tribal governments, tax-exempt organizations, and employers of state and local government employees. Those are the special situations where the 940 rules are a little bit different. Even though form 940 covers a calendar year, you may have to deposit your FUTA tax before you file your tax return. So keep that in mind. You're going to have to file this form. If you're a FUTA tax is more than $500 for the year, you have to make at least a deposit in one quarter. Make sure you pay...

Award-winning PDF software

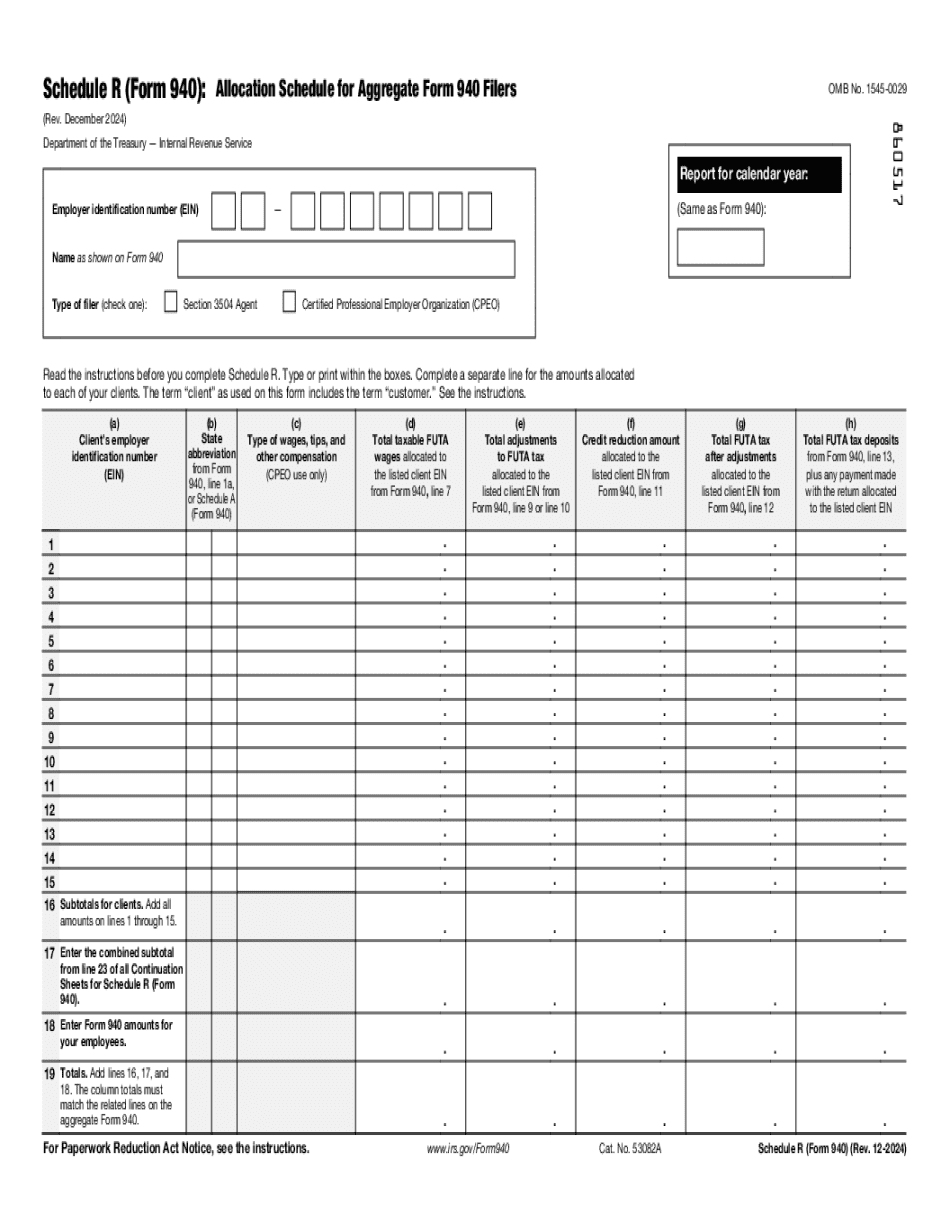

Video instructions and help with filling out and completing Who 940 Schedule R Form