Hi, welcome to the Easy Payroll Guide. My name is Karen Hutchinson, and in this video, I'm going to show you how to complete the IRS 941 form. The IRS 941 form is the employer's quarterly federal tax return. It is due at the end of each quarter. For example, quarter one ends on March 31st, and the form is due by April 30th. The due dates for the IRS 941 form are April 30th, July 31st, October 31st, and January 31st. This form details all of the tax liabilities for that quarter and is used to reconcile your W-3 forms with the IRS. It is crucial to ensure that the information on this form is correct. I will now provide a scenario of a small business with three employees. I have taken the information from their paychecks and put them into an Excel spreadsheet. This is a useful method for record-keeping and to help you complete or check the 941 form. The spreadsheet includes the gross pay for each employee, and I have totaled the gross pay in the last column. The total gross pay for the period is $25,465.27. I have also included the taxes withheld from each employee's paycheck, specifically the federal withholding, employee Medicare portion, and employee Social Security portion. Additionally, I have included the state withholding, although this is not needed for the 941 form, as it only requires federal taxes. Please note that in the case of Medicare and Social Security, you are responsible for paying the employer share of those taxes as well. When making deposits, you would multiply the Medicare and Social Security portions by two. This ensures that both the employee and employer contributions are paid. The Medicare and Social Security taxes for the entire quarter are noted on the spreadsheet. For the 941...

Award-winning PDF software

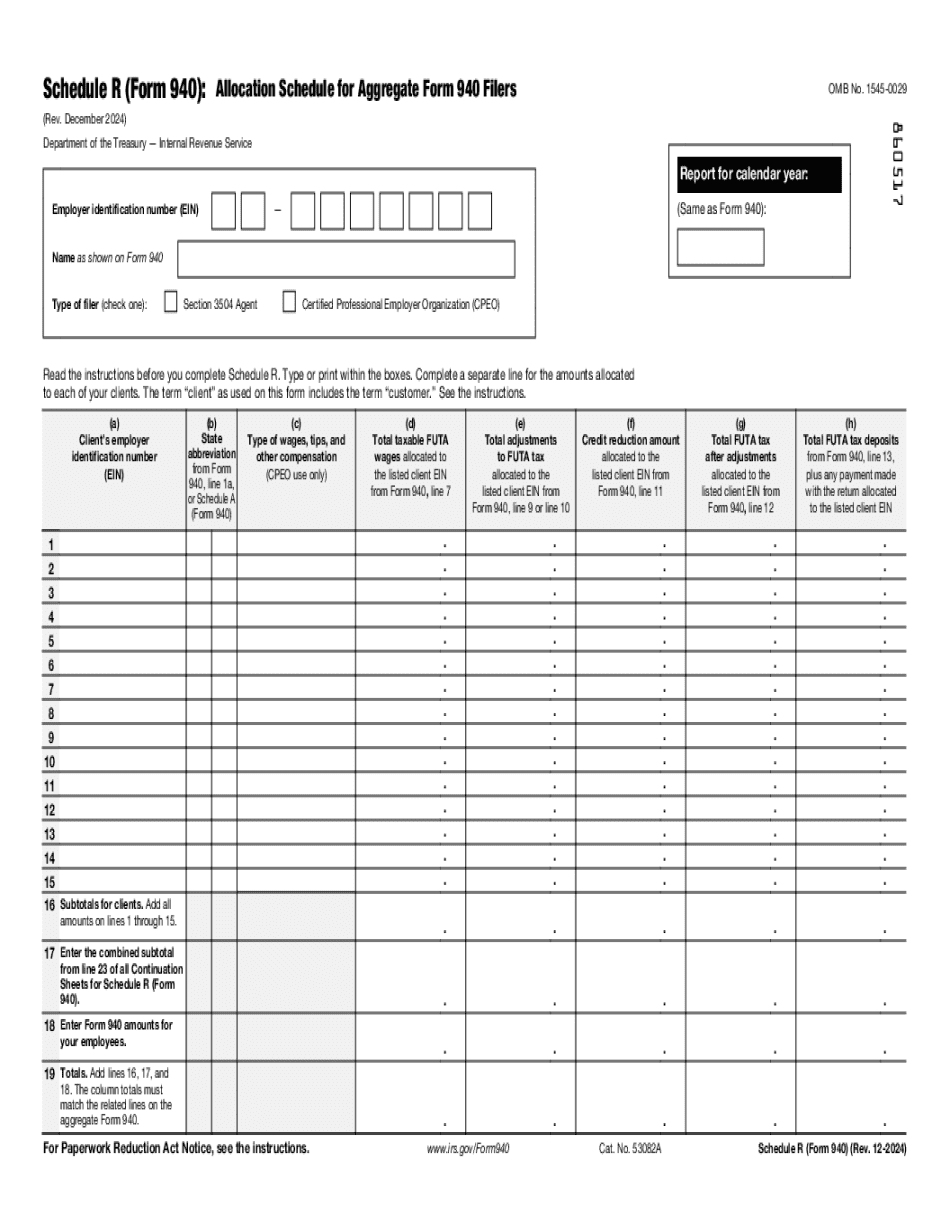

Video instructions and help with filling out and completing Irs Schedule R Form 940