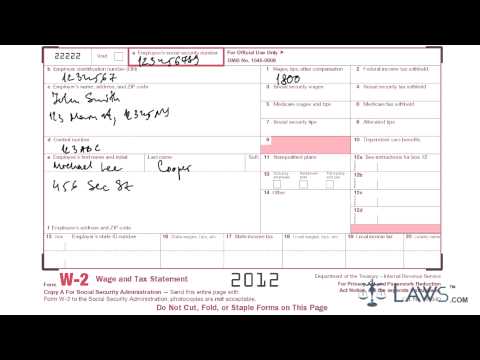

Laws.com provides a legal forms guide for the wage and tax statement form W-2. An employer is obligated to fill out a W-2 form for each employee, which records their earnings and the amount of income already set aside for taxes and funds. There are multiple copies of this form available for different purposes. Employers can obtain the form from the IRS website or a local office, while employees receive it from their employer. Here is a breakdown of the steps to complete the form: 1. The employer should enter the employees' social security number. 2. For sections B and C, the employer should enter their own employer identification number, name, and address. 3. Section D is for the control number assigned to each employee's return. 4. Section E records the employee's name and address. 5. Section one records the employee's total earnings. 6. Sections three, five, and seven indicate how much of the earnings are eligible for Social Security and Medicare garnishment. 7. Sections two, four, and six record how much of the wages were withheld for federal tax, Social Security, and Medicare payments. 8. Section eight records any reported tips. 9. Section ten records expenses for dependent care or services provided by the employer. 10. Sections eleven and twelve might not be applicable, so consulting official IRS instructions is advised. 11. Section thirteen indicates if an employee is statutory, has wages withheld for Social Security and Medicare but not federal income tax, is enrolled in a retirement plan, or received sick pay. 12. Sections fifteen through twenty record taxes withheld for state and local taxes, as well as the business name and location. 13. Complete all five copies of the form. Submit copy one to the state or local tax department, keep copy D for employee records, and mail the other three copies to the employee no later than January 31st. For more...

Award-winning PDF software

Video instructions and help with filling out and completing How 940 Schedule R Form