In this presentation, we will take a look at Form 941, Employer's Quarterly Federal Tax Return. For more accounting information and accounting courses, visit our website at accountinginstruction.info. Here's a copy of Form 941, specifically the 2018 version. You can find this form on the IRS website at irs.gov. Now, let's discuss the components of the form. First, at the top of the form, we have the EIN number, the name, and the address. It is important to indicate which quarter we are referring to since this is a quarterly form. Remember that a quarter consists of three months, and there are 12 months in a year, divided by four quarters. Please note that this is a quarterly form, different from the yearly form, which is known as Form 940, the yearly payroll tax form. It is vital not to confuse these two forms, even though they may seem similar. Form 941 is the primary form and is used to calculate federal income tax for employees, as well as the employer and employee portions of Social Security and Medicare. The reason for a quarterly form, rather than a yearly form, is that these amounts tend to be larger and more significant in terms of reporting. It is worth mentioning that we use a separate form, Form 940, for the FUTA (Federal Unemployment Tax Act), which is a smaller tax compared to the ones addressed by Form 941. While it is still a federal tax, the amounts involved are relatively smaller. Moving on to the form itself, Part One requests the number of employees who received wages, tips, or other compensation. In our case, we have four employees for this quarter. To determine this number accurately, we need the specific day within the quarter when we count the employees. Next, we have the wages, tips, and...

Award-winning PDF software

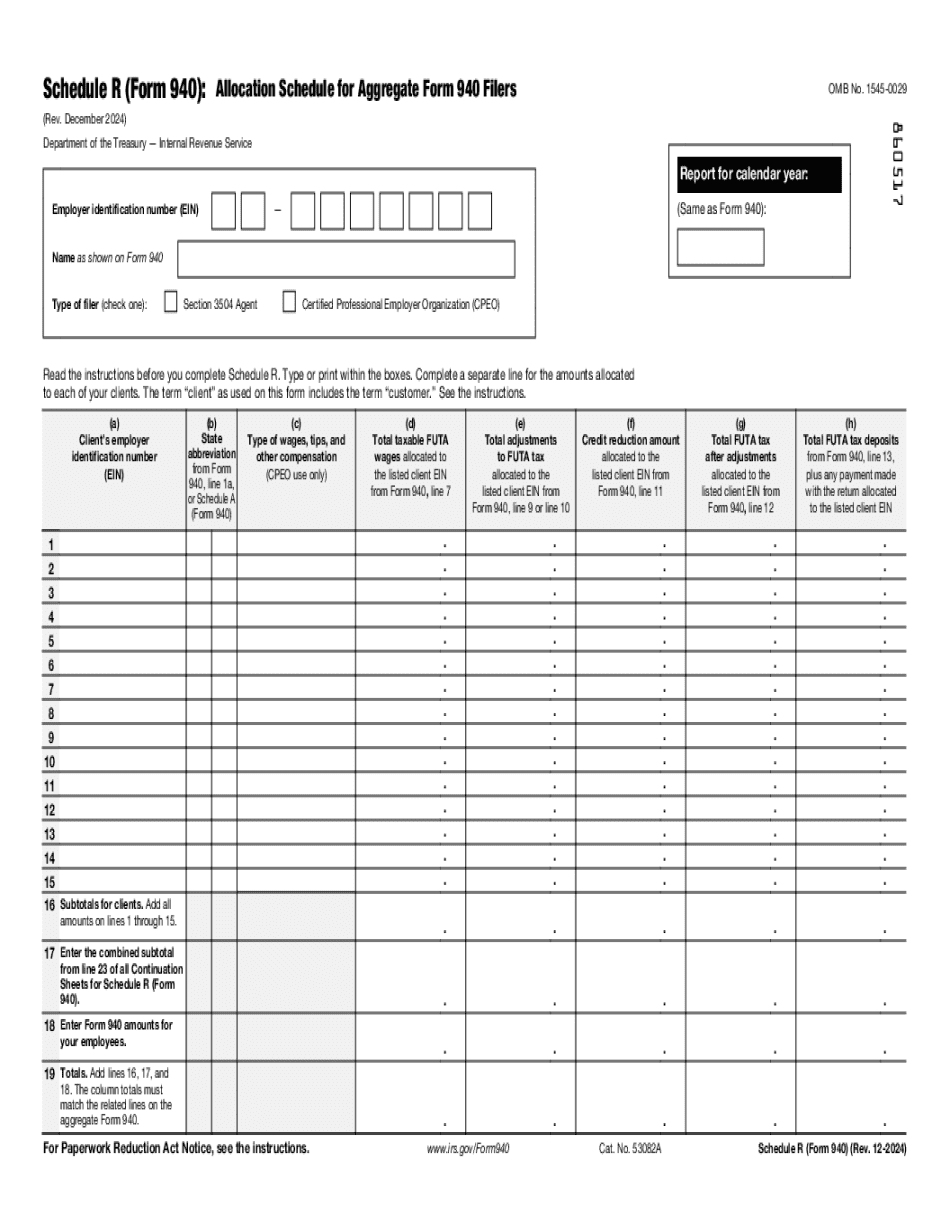

Video instructions and help with filling out and completing Fill 940 Schedule Return