Hi everybody, my name's Tim and today I'm going to talk to you a little bit about the Federal Unemployment Tax Act, or FUTA for short. Most businesses participate in a state unemployment tax program, so they get a credit before they pay federal unemployment tax. The net FUTA rate is almost always 0.8 percent, which is the same as 0.008. The maximum amount of an individual's wages that will be taxable to the employer is $7,000. Therefore, the most any employer will pay for federal unemployment taxes is $56 per year. Let's take an example. Suppose an individual earns $800 a week. Federal unemployment taxes are paid on a quarterly basis, and there are 13 weeks in a quarter. If we multiply $800 by 13, we get a total wage for the quarter of $10,400. Since the maximum taxable for FUTA is $7,000, we will only pay tax on that amount. This means that $3,400 of the wages are not taxable. For this individual in the example, the taxable amount is $7,000. We multiply this by 0.008 and get $56 that we have to pay in FUTA taxes. Now let's look at another example. We have three quarters: first, second, and third. Consider a part-time individual who gets paid $200 a week. So, in each quarter, this person earns a total of $2,600. Multiplying this by 0.008, we get $20.80 that we have to pay in FUTA taxes for the first and second quarters. However, in the third quarter, this individual has already reached the maximum taxable amount for FUTA, which is $7,000. They have already paid taxes on a total of $5,200. So, the remaining $1,800 is taxable. Multiplying this by 0.008, we get $14.40 that we have to pay in FUTA taxes for the third quarter. Adding up the taxes paid...

Award-winning PDF software

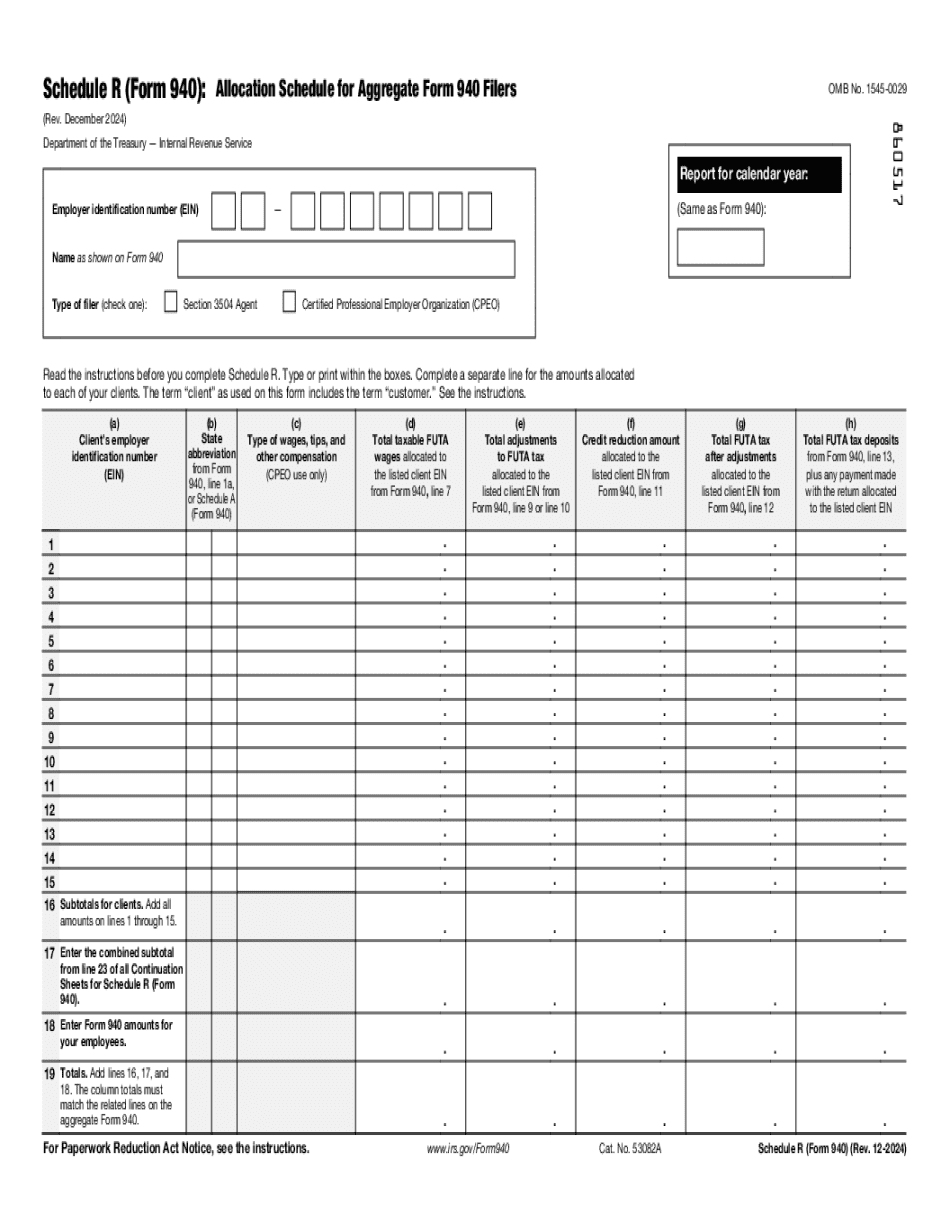

Video instructions and help with filling out and completing Fill 940 Schedule Reduction Rates