Hi, welcome to Easy Payroll Guide. My name is Karen Hutchinson and in this video, we're going to talk about how to use the percentage method when calculating withholding taxes for employees. This method can be used for any employee, regardless of their chosen withholding allowances or the amount of their wages. To calculate withholding taxes, you will always need to use the employee's W-4 form, which provides all the necessary information. In this example, we will use the fictitious character John Doe, the same example used in my previous video on the wage bracket method. John is single and claims only one allowance. This information is filled out by the employee and must be used when calculating their withholding tax. He is paid on a bi-weekly basis, with wages for this pay period totaling $720. The first step in this calculation is to refer to the IRS publication 15, which provides a percentage method table. These amounts are for 2014 and are broken down by pay period and withholding allowance. In this case, we will multiply one withholding allowance by the amount for John's pay period, which is $151.90. Since John has only claimed one allowance, we will use this amount for the calculation. Next, in step two, we subtract the calculated amount from John's wages. His wages were $720, and after subtracting $151.90, we are left with $568.10. This is the amount we will use to determine how much tax to withhold. To find the withholding tax amount, we need to refer to the correct withholding tables in publication 15, which are on pages 43 and 44. These tables are specific to the percentage method and are categorized by pay period and marital status. We locate the section for bi-weekly pay periods and single individuals. From there, we find the range...

Award-winning PDF software

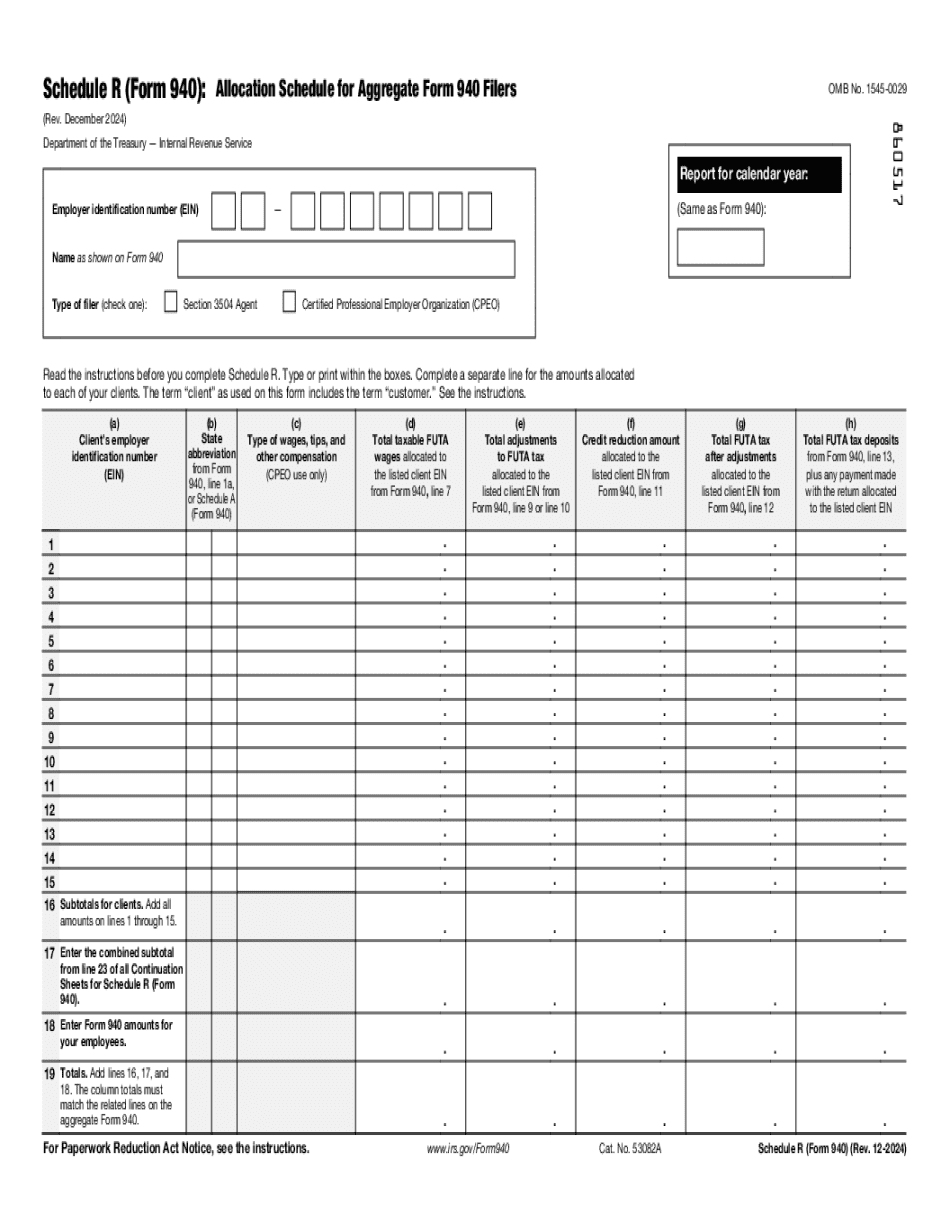

Video instructions and help with filling out and completing Fill 940 Schedule R Form