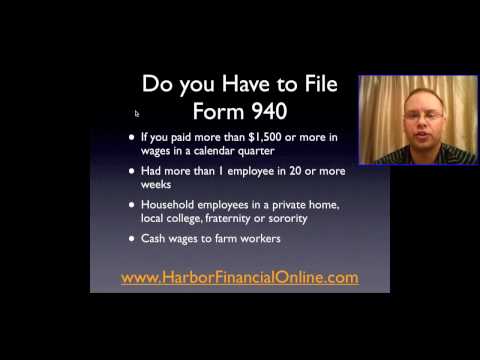

Welcome back to another video for Harbor for Nacho Online.com. Today, I'm going to be talking about Form 940 and the instructions. I will walk you through the requirements and show you how to fill out the form correctly. The Form 940 is used to report annual federal unemployment taxes. Many companies are required to fill out this form but may not realize it. If you have employees, you are required to fill out the Form 940. It provides funds for unemployment compensation. The compensation amounts are not deducted from employee payroll. It is important to accurately fill out the form to avoid errors. Harbor Financial Online.com provides a platform to prepare the Form 940 and other business tax returns. You can also learn more about your tax and filing requirements by visiting the website. If you have paid $1,500 or more of wages in any calendar quarter, you are required to complete the Form 940. If you have more than one employee and 20 or more weeks, you must also fill out the form. Household employees in a private home, local college, fraternity, or sorority are also required to fill out the form. Cash wages paid to farm workers also trigger the requirement. The specific requirements may vary based on your location and organization type. Indian tribal government tax-exempt organizations and employers of state and local governments are also required to complete the Form 940. It is important to deposit your Federal Unemployment Taxes before filing your return. If your tax is more than $500 for the year, you need to make quarterly payments. Harbor Financial Online.com offers more information on the Form 940 and allows you to complete it directly on the website. They also provide a tax calculator and other resources to help you better understand your...

Award-winning PDF software

Video instructions and help with filling out and completing Are 940 Schedule Return